Have you opened an account in India Post Payment Bank recently? You might not know that India Post Payment Bank does not provide their customers the debit cards. Instead, IPPB provided its customers with a QR card, which could be used for basic banking transactions at post offices and other channels. India Post Payment Bank provides you with a virtual debit card, which you can activate through the IPPB mobile app.

India Post Payments Bank (IPPB) is a government-operated financial institution in India that was established to provide basic banking and financial services to the unbanked and underbanked population in the country. It was launched on September 1, 2018.

This bank is getting more popular in the countryside, but why is it not providing a debit card? This is just a myth IPPB provide you with a debit card but in virtual form, which you can use for UPI transactions and cardless transactions. To get your virtual card read the article further.

How to obtain your India Post Payment Bank Debit card?

India Post Payments Bank (IPPB) provides services including savings accounts, current accounts, and electronic wallets, but it doesn’t issue physical debit cards. Instead, customers are provided with a QR card or a virtual debit card for digital transactions.

Generating a debit card on your IPPB account is chargeable, Rs 25 will be deducted from your account automatically while activating the card. Here are the steps on how to activate an IPPB debit card:

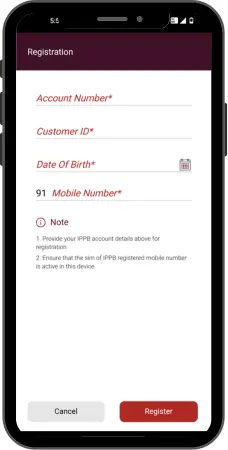

- Download and open the Indian Post Payment Bank Mobile application.

- Get logged in by entering your account number, customer ID (this information is available on a QR card, which you got from the bank after opening your account), and mobile number, then click on the “Register” button.

- Set a 4-digit MPIN, then click on the “Set MPIN” button. (Now it will send you an OTP to your registered mobile number.)

- Enter OTP and click on the “Submit” button.

Now you have registered on the India Post Payment Bank Mobile app successfully.

- Now for login, click on the “Login” button and enter your MPIN there.

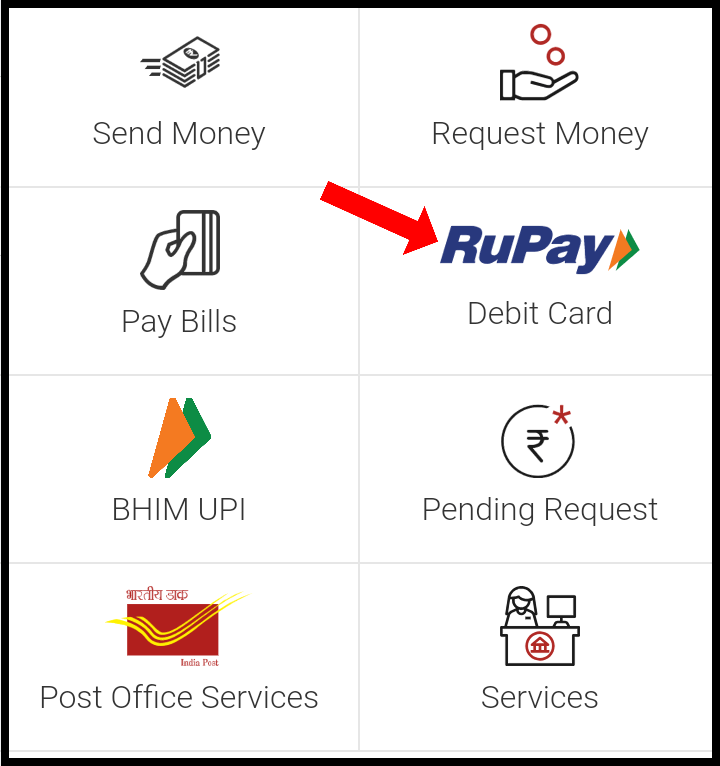

- Sroll down and find “Rupay Debit Card” under My Services section, and click on it.

- There you will see ‘no vertual debit card for this account‘ because you have’nt activated yet. There you will also see “Request Virtual Debit Card” button, click on it.

- Now you will be shown a new screen where you will see the card type, validity (not changable), a checkbox of terms and conditions which you have to check, then click on “Confirm” button.

- A new Terms and Conditions page will open where is mentioned that Rs 25 will be debited from your IPPB account only, click on “Continue” button.

- You now have to authenticate with OTP, for that insert the OTP which will receive on your registered mobile number, then click on “Submit” button.

- Finally you will be shown a success message, that means a Rupay virtual debit card is issue to your India Post Payment Bank account.

- You have to wait for 30 minutes until your card will be activated for online transactions.

Now using your virtual card details, you can do online transactions as well as cardless transactions on ATM machines.

Also read: How to update the mobile number of IPPB account online?

How to view IPPB virtual debit card details?

Once your India Post Payment Bank debit card is activated you can immediately view your card details in the IPPB Mobile app, here are the steps to display your virtual card details:

- Open the IPPB Mobile app and log in by entering your MPIN.

- On the home screen, scroll a bit down, find the “Rupay Debit Card” option under My Services, and click on it.

- You will be shown your card, but the details are still hidden. Below the card there is a “View Card Details” button, click on it.

- Then enter the MPIN, and click on the “Confirm” button.

- Now you can see card details including cardholder name, card number, CVV, and expiry date.

You can now use this card detail into any online transaction applications like UPI, Google Pay and Phone Pay.

Also read: How to Apply for Bajaj Finserv Insta EMI Card?

FAQs about India Post Payment Bank debit card

Q. What type of debit card do we get from IPPB?

→ IPPB provides their customer with a Rupay debit card.

Q. How much is the validity of this debit card?

→ IPPB issues debit card with 60 months (5 years) validity.

Q. What are the charges for having this debit card?

→ Rs 25 at the time of issuance and Rs 25 as annual maintenance will be charged

Also read: How to delete transaction history in Google Pay app?

Wrapping up

This is the whole process of obtaining the India Post Payment Bank virtual debit card. This is not mandatory to activate the debit card, in fact, you can still use your IPPB account without having an activated debit card. But if you want to use your IPPB account for online transactions, in this case, it is mandatory to have a debit card issued on that account.